How To Save Money On Your RV’s Solar And Battery System With The Federal Solar Investment Tax Credit

Whether you’re a seasonal RV traveler or have fully embraced RV living, you’re likely drawn to the freedom and adventure that RV life brings. However, the pandemic and associated recession have resulted in record growth in travelers adopting the RV lifestyle, and 2021 is anticipated to be the RV industry’s biggest year since 1983. With more and more RVs crowding RV parks and campgrounds, solar-powered RVs have the distinct advantage of being able to boondock for long periods of time in more remote and tranquil locations. In addition to greater independence, solar-plus-storage RVs also provide significant energy savings. Even better, the federal government is now offering RV homeowners a tax credit for installing solar and energy storage systems.

The Final Year to Receive the Full 26% ITC is 2022

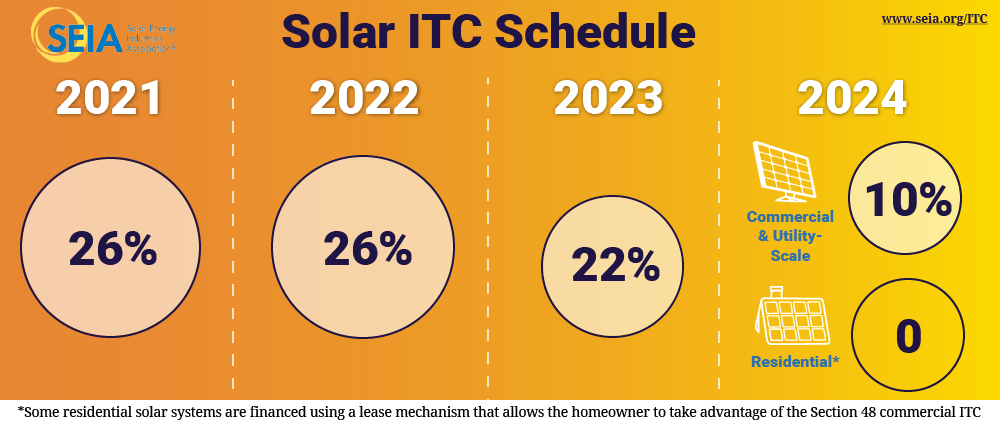

Since 2005, the federal solar investment tax credit (ITC) has enabled RV homeowners to save thousands of dollars on their solar-plus-storage systems throughout the U.S. Lawmakers have also established a “step-down” schedule to eliminate this tax credit in the coming years. Current and prospective solar energy system owners only have until December 31, 2022 to take advantage of the full 26% ITC for both solar and energy storage investments. On January 1, 2023, the tax credit will be reduced to just 22%.

What is the Federal Solar Investment Tax Credit (ITC)?

The ITC is one of the top financial incentives for solar and energy storage in the U.S. Under Section 25D of the ITC, homeowners who purchase solar energy systems outright can deduct 26% of the cost of the system from their federal income taxes. This program applies to all “dwelling units,” including houses, mobile homes, boats, and RVs. Whether you are boondocking, a digital nomad, van dweller, part-time or full-time RV user, this tax credit will apply to your RV if it qualifies as, or has been accepted by the IRS as, a second home for tax purposes. You also must own your solar energy system, rather than lease it from a third-party provider, in order to be eligible for the ITC. Notably, in the event you don’t have enough tax liability to claim the full credit in one year, you can simply “rollover” the remaining credits into future years, so long as the ITC is in effect.

The ITC Step-Down

The final years to take advantage of the full 26% tax credit are 2021 and 2022. In 2023, the final year that RV homeowners can claim the ITC, the ITC will be stepped down to just 22%. Starting in 2024, the ITC will be just 10% and will only be accessible for commercial and utility solar projects.

How can the ITC be used for your RV’s solar battery bank?

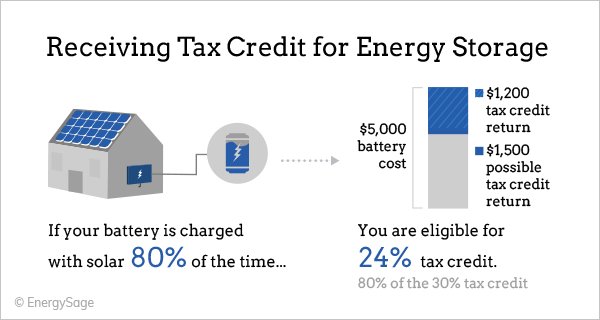

Since batteries aren’t considered renewable energy, as they can also be charged by grid electricity, your RV’s solar battery bank is only eligible for the ITC if it is charged by renewable energy. Motorhome owners who are looking to receive the 26% ITC for their energy storage systems may do so as long as the batteries are only charged by on-site solar or other renewable energy. If your RV doesn’t have solar panels installed and you plan to charge the batteries with electricity from the grid, the project isn't eligible for the ITC.

If you’re in the market for a solar or energy storage system for your RV, don’t wait until it’s too late. Take advantage of the full 26% tax benefit for your RV’s energy storage plus solar project and contact a RELiON representative for more information today.

*Any taxpayer considering purchasing a solar energy or energy storage system should consult their accountant or other tax professional before claiming a tax credit.